Hard Money Loans Process – What To Expect

What if you could borrow money without going through traditional lending sources? What would happen if investors gave you the money instead? You can do this, and it's quick and easy. We call it hard money loans.

How a Traditional Loan Works

Traditional lenders will evaluate your credit score and income in order to determine whether or not you can receive approval. If you have a high debt-to-income ratio or bad credit, you're going to find it a lot harder to get approved.

Traditional lenders use a painfully slow and tedious process to determine your approval or denial. You may be stuck waiting for weeks before they can find enough verifiable income evidence, or they might reject you if you have anything negative on your credit report.

Even if you have a steady income, it can still be difficult to purchase an investment property with bad credit.

How a Hard Money Loan Works

With a hard money loan, you don't need to go through the long and tedious process of qualifying for traditional financing. Instead, hard money lenders offer loans on more favorable terms than banks and other financial institutions.

Unlike traditional loans, hard money is based on the collateral you have securing your loan. Anything of high value that can be used to repay the loan is suitable, such as a property or other valuable possessions. This ensures that the lender has something to show for its risk if the borrower defaults on their payment.

As you can see, hard money lenders are much more concerned with your ability to repay the loan than big banks and other financial institutions. What they're looking at is the collateral you put up for your loan.

Credit may not be the same for everyone, but at LBC Capital, we know that with a little extra help and guidance it doesn't have to be. This is why we've made our approval process as quick and easy as possible--so you can access the funds you need to build a better future.

Best Way To Use Hard Money Loans

If you need money to grow your business, hard money loans can be an excellent way to do so.

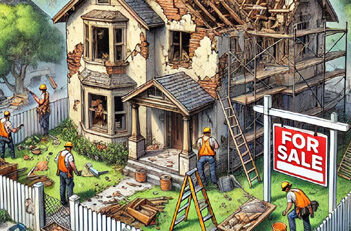

Ideally, you’ll want to use a hard money loan for fixer-upper properties, commercial properties, residential, warehouse, bridge loans, land and construction since they are best suited for short term projects with good ROI. However, hard money loans can be expensive and lenders may value your property less conservatively than expected. If the property is deemed a fixer-upper or in need of serious repairs, you may be better served by applying to an FHA 203k loan instead.

Traditional Banks VS. Hard Money

Banks: They're all the same, right? Well, not quite. We'll show you the benefits of using The Bank and all we offer. Whether you’re a new business owner or an established entrepreneur, our banking is perfect for any situation.

Things are made fast and easy when it comes to hard money loans. And that's why people ask "why would anyone ever want to use a bank again?" The question is good.

Compared to other options, hard money loans are best for people who want to finance a short-term project, such as construction, fix and flip or remodel with an intention to sell. They're not appropriate for long-term goals like mortgages (30 years or more). Remember that interest rates are usually higher on hard money loans than on traditional loans so you may want to find out more before signing up.

Hard money loans may not be for everyone, but there are some serious benefits that make the potential downsides worth it. All of the following will give you an idea of how lucrative hard money loans really can be:

Fast Approval Process – Hard money lenders are different from traditional banks since they don't care about your credit score and other minutiae. What they care about most is the piece of property you want to use as collateral. This means that you can get the loan you need - fast! On top of that, traditional lenders take their time with things like vetting your income and reviewing your bank balances for any reason not to give you the loan.

Processing Speed - When you live in a hot, competitive real estate market, speed is your friend. You need to close on deals quickly otherwise you'll lose out. The last thing you want is being in an ugly bidding war and wasting time with a bank that's dragging their feet!

Personal Touch - It can be tough to get a loan with a traditional bank. It's difficult to get the right decisions made without being able to state your case to a person who it willing to listen. With a local Los Angeles hard money lender, you'll have access to an individualized process and opportunities for flexibility.

Loan Programs

Need a Professional Advice?

It’s time to boost your business!

Find out the cost, timing and list of works for your project